Shareholders

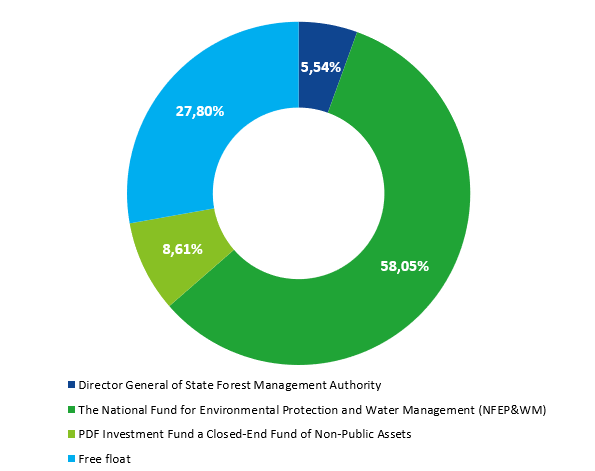

Shareholders with holding directly or through subsidiaries shares empowering them to exercise at least 5% of votes in the General Meeting of Bank Ochrony Środowiska S.A. in Warsaw.

| Shareholder | Number of shares | Percentage share in initial capital |

|---|---|---|

| National Fund for Environmental Protection and Water Management (NFOŚiGW) | 53 951 960 | 58,05 |

| PDF Investment Fund a Closed-End Fund of Non-Public Assets | 8 000 000 | 8,61 |

| General Directoriate of The State Forests | 5 148 000 | 5,54 |

| Free float | 25 847 711 | 27,80 |

With share capital of PLN 929 476 710.

- One share gives a right to one vote at the general shareholders meeting.

Other capital is dispersed.

The share capital of BOŚ S.A. is composed of 92 947 671 shares, including:

- 236 700 series A shares

- 1 263 300 series B shares

- 500 000 series C shares

- 1 300 000 series D shares

- 700 000 series E shares

- 1 500 000 series F shares

- 1 260 000 series G shares

- 670 000 series H shares

- 70 000 series I shares

- 1 055 000 series J shares

- 945 000 series K shares

- 1 200 000 series L shares

- 2 500 000 series M shares

- 1 853 000 series N shares

- 1 320 245 series O shares

- 6 500 000 series P shares

- 40 000 000 series U shares

- 30 074 426 series V shares

Rating

On 20 September 2024 Fitch Ratings Ltd (Agency) confirmed ratings and outlook.

Below are the current ratings of BOŚ S.A.:

Long-term Foreign Currency IDR: ‘BB-’, outlook stable,

Short-term Foreign Currency IDR: ‘B’,

National Long-term Rating: ‘BBB-(pol)’, outlook stable,

National Short-term Rating: ‘F3(pol)’,

Viability Rating: ‘bb-’,

Government Support: ‘b’

Rating for subordinated bonds: ‘BB(pol)’.

In its ratings action commentary, the Agency pointed out the Bank’s generally stable funding

and liquidity position, with moderate capital buffers as well as improved, but lower

profitability than its competitors, amid a lower risk aversion and weaker asset quality.

History of operations on shares

Before BOŚ S.A. got its shares approved for public trading and for stock market trading the Bank issued shares in series A to K in the period from 28 Sep 1990 to 26 Apr 1996.

BOŚ S.A. got approval for public trading of its shares on 12 September 1996, and for stock market trading along with a first quotation date on 3 February 1997. The shares launched at a debut price of PLN 48.00 per share.

| Series | Date of issue | Number of shares In issue | Issue price [PLN] | Date issue was registered | Share capital following registration |

|---|---|---|---|---|---|

| A | 28.09.1990 r. | 236 700 | 10,00 | 9.01.1991 r. | 2 367 000 |

| B | 3.07.1991 r. | 1 263 300 | 15,00 | 11.03.1992 r. | 15 000 000 |

| C | 29.05.1992 r. | 500 000 | 15,00 | 30.12.1992 r. | 20 000 000 |

| D | 14.05.1993 r. | 1 300 000 | 18,00 | 30.12.1993 r. | 33 000 000 |

| E | 25.05.1994 r. | 700 000 | 18,00 | 30.06.1994 r. | 40 000 000 |

| F | 5.12.1994 r. | 1 500 000 | 18,00 | 30.12.1994 r. | 55 000 000 |

| G | 17.05.1995 r. | 1 260 000 | 18,00 | 30.06.1995 r. | 67 600 000 |

| H | 17.05.1995 r. | 670 000 | 10,00 | 30.06.1995 r. | 74 300 000 |

| I | 17.05.1995 r. | 70 000 | 10,00 | 30.06.1995 r. | 75 000 000 |

| J | 26.04.1996 r. | 1 055 000 | 12,00 | 21.06.1996 r. | 85 550 000 |

| K | 26.04.1996 r. | 945 000 | 21,00 | 21.06.1996 r. | 95 000 000 |

| L | 21.06.1996 r. (public offering) | 1 200 000 | 29,00 | 29.11.1996 r. | 107 000 000 |

| M | 17.10.1997 r. (public offering) | 2 500 000 | 39,18 | 7.05.1998 r. | 132 000 000 |

| N | 19.12.2006 r. (private subscription) | 1 853 000 | 92,00 | 13.06.2007 r. | 150 530 000 |

| O | 9.12.2009 r. (private subscription) | 1 320 245 | 72,83 | 25.06.2010 r. | 163 732 450 |

| P | 23.09.2011 r. (private subscription) | 6 500 000 | 35,00 | 15.06.2012 r. | 228 732 450 |

| U | 25.05.2016 r. (private subscription) | 40 000 000 | 10,00 | 12.07.2016 r. | 628 732 450 |

| V | 26.03.2018 r. (private subscription) | 30 074 426 | 10,00 | 03.07.2018 r. | 929 476 710 |

The Securities Commission approved, 12 September 1996 (decision No. RF-411-13/96-48/96), a total of 10 700 000 BOŚ S.A. shares series A to L for public trading.

The Supervisory Board of Giełda Papierów Wartościowych w Warszawie S.A. stock exchange approved, by Resolution No. 2/388/97 of 15 January 1997, BOŚ S.A. ordinary bearer shares series A to L for trading on the main market.

The Supervisory Board of Giełda Papierów Wartościowych w Warszawie S.A. stock exchange introduced, by Resolution No. 25/97 of 24 January 1997, in ordinary procedure, BOŚ S.A. ordinary bearer shares series A to L for trading on the main market.

The Securities Commission approved, 11 December 1997 (decision No. RF-411-117/97-171/97) a total of 2 500 000 BOŚ S.A. series M shares for public trading.

The Management Board of Giełda Papierów Wartościowych w Warszawie S.A. stock exchange approved, by Resolution No. 316/98 of 29 May 1998, 2 500 000 BOŚ S.A. series M shares for stock market trading, and next, by the same Resolution, introduced, in ordinary procedure, for trading on the main market.

The Polish Financial Supervision Commission [KNF] approved, 16 October 2007 (decision No. DEM/410/147/16/07), a prospectus the company BOŚ S.A. executed towards its intended request of approval for trading BOŚ S.A. series N shares on the regulated market.

The Management Board of Giełda Papierów Wartościowych w Warszawie S.A. stock exchange approved, by Resolution No. 933/2007 of 22 November 2007, 1 853 000 BOŚ S.A. series N shares for stock market trading, and next, by the same Resolution, introduced, in ordinary procedure, for trading on the main market.

The Annual General Meeting of BOŚ S.A. on 17 June 2008 did not adopt a resolution on the issue of the Bank’s series P1 registered bonds, a conditional increase in the share capital of BOŚ S.A. through the issue of series O shares, disapplication of pre-emption rights for series O shares and disapplication of pre-emption rights for series P1 registered bonds, and on amendments to the Articles of Association of the Bank and on the introduction of series O shares for trading on the regulated market.

The Management Board of Giełda Papierów Wartościowych w Warszawie S.A. stock exchange approved, by Resolution No. 664/2010 of 15 July 2010, 1 320 245 BOŚ S.A. series O shares for stock market trading, and next, by the same Resolution, introduced, in ordinary procedure, for trading on the main market.

The Management Board of Giełda Papierów Wartościowych w Warszawie S.A. stock exchange approved, by Resolution No. 621/2012 of 28 June 2012, 6 500 000 BOŚ S.A. series P shares for stock market trading, and next, by the same Resolution, introduced, in ordinary procedure, for trading on the main market.